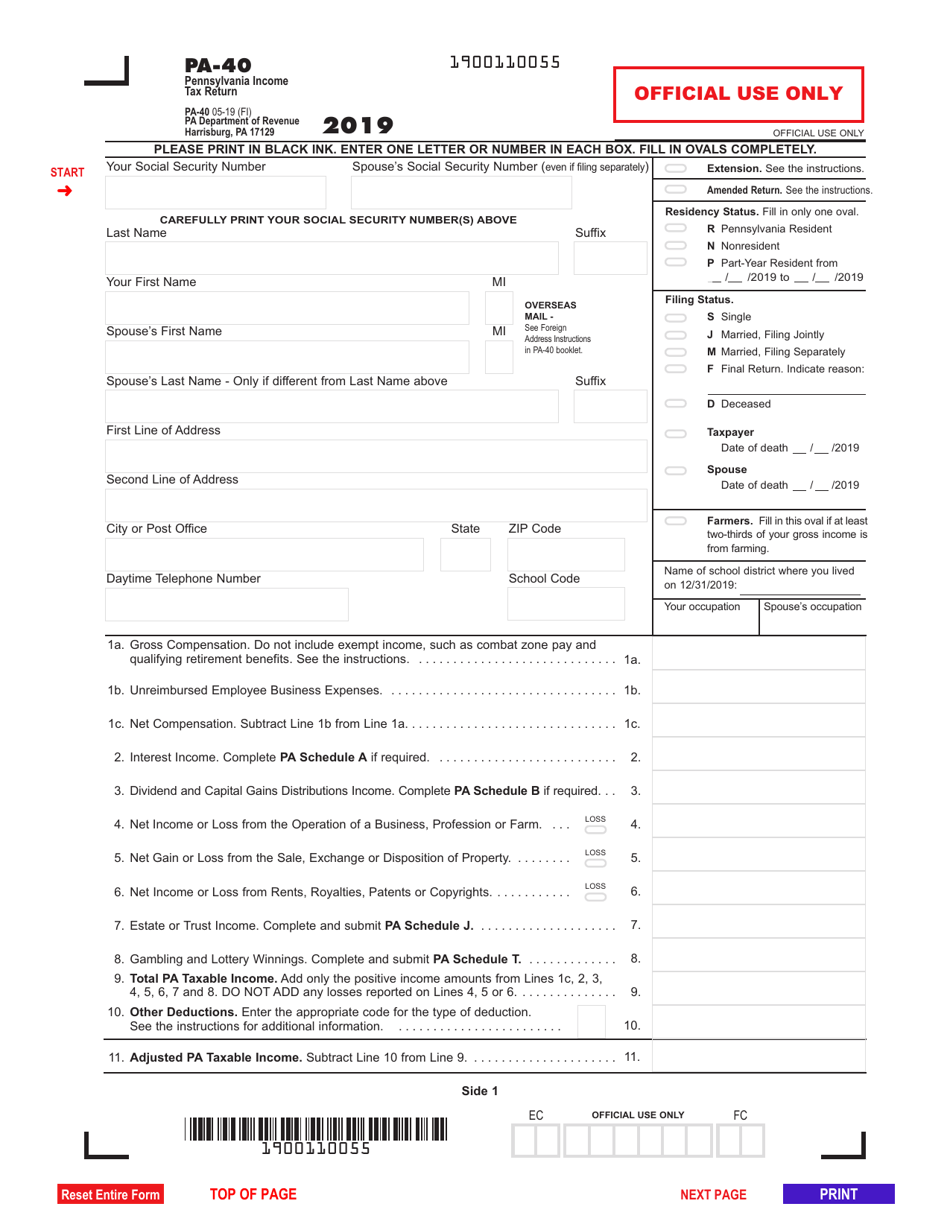

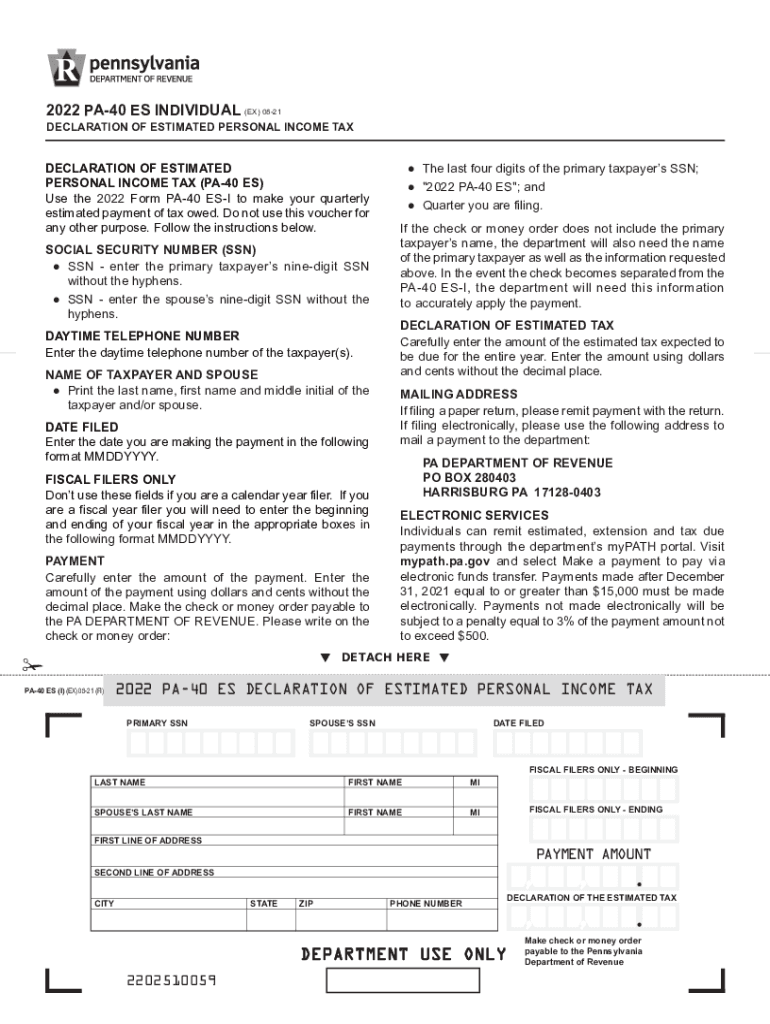

2025 Estimated Tax Forms Pennsylvania. The pennsylvania income tax estimator will let you calculate your state taxes for the tax year. Estimated underpayment penalty is calculated on the amount of underpayment for each installment period multiplied by both the daily interest rate for the tax year (and the.

The most common pennsylvania income tax form. New electronic payments options are now available through mypath.

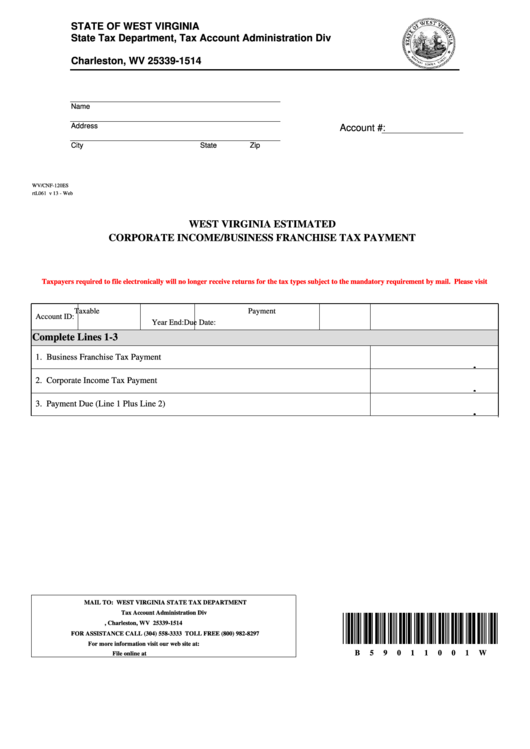

2025 Pa Estimated Tax Forms Brier Claudia, If you estimate your tax to be $500 for the 2025 taxable year, you should make your payment of $500 by april 15, 2025).

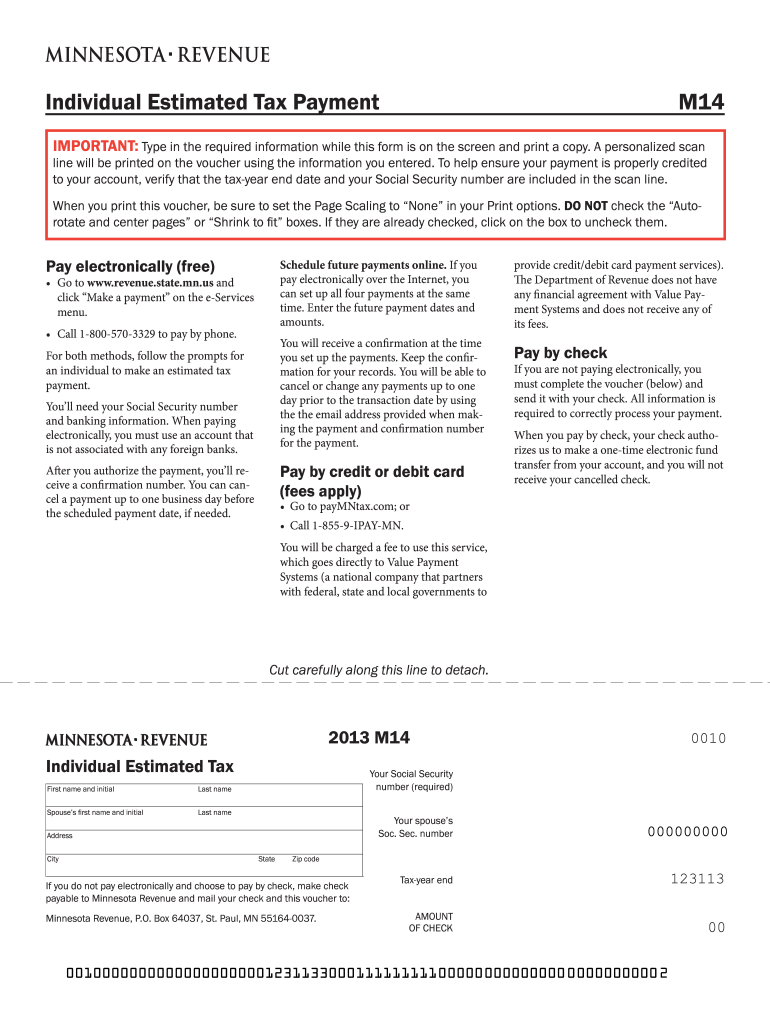

Quarterly Tax Calculator Calculate Estimated Taxes (2025), You can complete the forms with the help.

Pa Estimated Tax Payments 2025 Pdf Tandy Florence, File online with pa department of revenue file by mail must.

2025 2025 Estimated Tax Form And Instructions Afton Ardenia, Links to federal and state tax forms and government offices.

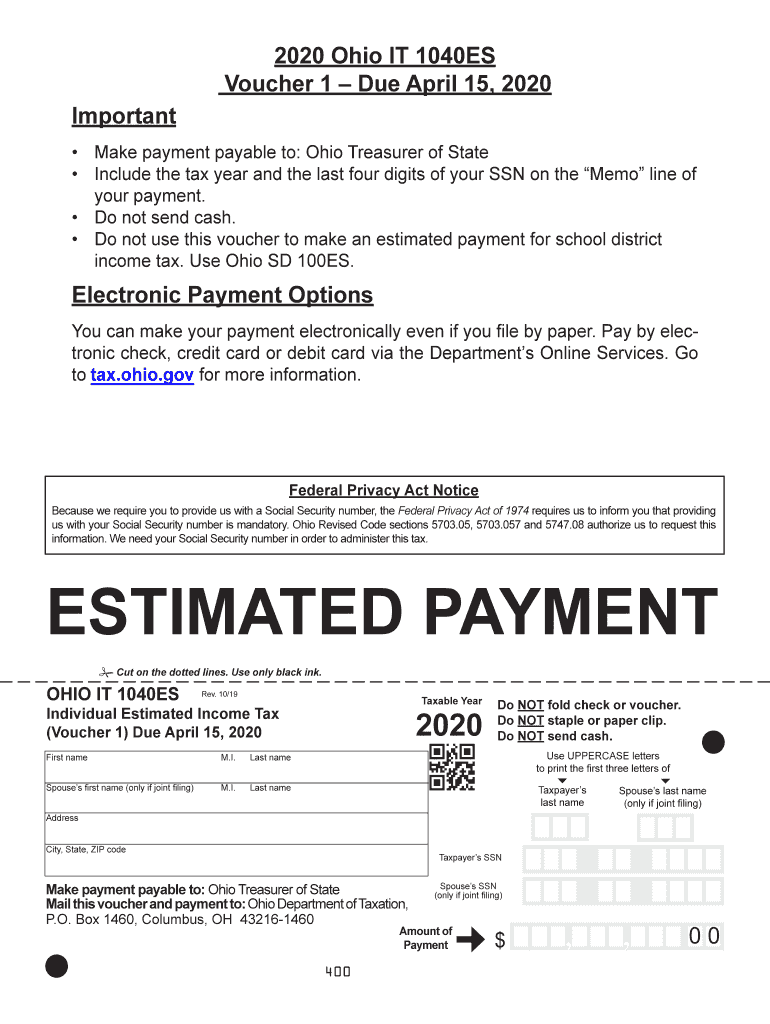

Irs Estimated Quarterly Tax Payment 2025 Cyndi Rebecca, Estimated underpayment penalty is calculated on the amount of underpayment for each installment period multiplied by both the daily interest rate for the tax year (and the.

How To Pay Estimated Taxes For 2025 Online Betsy Charity, The declaration of estimated tax provides a taxpayer a means of paying commonwealth personal income tax on a current basis if the taxpayer has taxable income not subject to withholding.

2025 2025 Estimated Tax Form And Instructions Afton Ardenia, What forms do i need to file a pennsylvania personal income tax return?

2025 2025 Estimated Tax Form And Instructions Dix Vickie, The most common pennsylvania income tax form.